Discovery Invest Quarter 3 Fund Webinar

- 56 mins 55 secs

Interest rates, inflation and rand weakness continued to dominate headlines over the past quarter, as local and global investment markets remained volatile. While the knee-jerk reaction in these situations tends to be a move into cash and income portfolios, we know that over the long term this will not garner adequate value for your clients.

Join Hannes van den Berg, who plays a pivotal role within the investment team behind the Discovery Balanced Fund, and Louis Niemand, investment director, from Ninety One. They’ll talk through the past quarter's performance and where we see the alpha opportunities for investors.

Channel

Discovery InvestSpeaker 0:

Good morning, everyone. And welcome to the third quarterly fund webinar on the Discovery Balanced Fund range. We are very fortunate today to have Van be head portfolio manager of the Discovery Balanced Fund Range, as well as Louis Nant, investment director at 91 to take us through the updates.

Speaker 0:

I'm from Discovery Invest and I will do a quick introduction before I hand over to Louis.

Speaker 0:

In this slide, we show something that very few balanced funds, if any other balanced funds can show. And this is that the Discovery Balanced Fund range has consistently outperformed its peers over all rolling periods since inception. Whether you look at rolling one year, three year, five year, seven or 10 year periods, the numbers that we show here are end of June numbers and these are native fees.

Speaker 0:

Um, and as I've mentioned in a previous update, we prefer to look at rolling performance as opposed to static performance, as this gives a much more accurate, um, and comprehensive view of the investment performance over all um, market cycles and market conditions.

Speaker 0:

So for those of you that are following the balanced investor edition that we've been sending out over the last 6 to 8 months. We've had four of these so far. You might recognise this slide,

Speaker 0:

but here I'm showing what makes the Discovery Balanced Fund fund range so unique. So firstly, it is the unique equity philosophy. So here we choose stocks that show an improved, um, earnings revision or, in other words, upward trending consensus earnings at a reasonable valuation.

Speaker 0:

This strategy has been very successful in the past in the local and global markets, but it does struggle at inflexion points like we have seen over the last year. However, over the long term, this strategy has outperformed all other strategies. Secondly, 91 is the only South African manager that is true, truly, globally, integrated.

Speaker 0:

There's a very large investment team sitting in London, in fact, larger than the South African team, and they interact and speak to the South African team on a daily basis. Third, they've proven out performance like I've shown in the previous slide over all rolling periods. And in the next slide, I will show this over the very long term on a cumulative basis.

Speaker 0:

So in this slide you can see the Discovery Balanced Fund. This is the white line over the last 16 years, significantly outperforming beers as well as CP I and cash.

Speaker 0:

So we often show this slide. But it is worth noting the discovery in V is still the fastest growing active retail ma manager in South Africa.

Speaker 0:

And according to the latest CS A stats, the top five flow taker in the industry over the last five years, And in saying that three of the flow takers that that are ahead of Discovery invest are not true active, um, asset managers. So essentially, we are the second largest flow taker in the industry.

Speaker 0:

And then the Discovery Balanced Fund, the second largest flow taker, um, in its sector over the last five years. And we thank you for your support in this regard.

Speaker 0:

So this leaves me to hand over to Louis and Hanna. Uh, we thank you for all of you who have submitted questions. We have given it through to 91 and this will be dealt with within the presentation over to Louis.

Speaker 1:

Good morning. Uh, everybody and ST, thank you so much for the introduction.

Speaker 1:

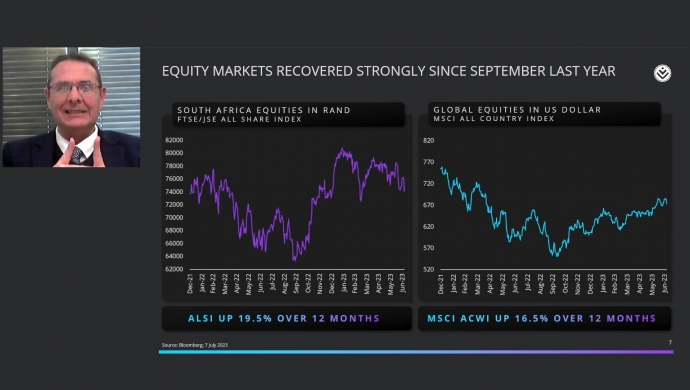

Um, we've seen a very strong recovery in equity markets and the big question is. Has that been it, or is there more to come?

Speaker 1:

Um, if we look at the last just the last 16 or 18 months on equity markets and the two graphs that we actually show here is the local market on the left-hand side and purple and then in the bluish colour on the right hand side global equity markets and we can see a sharp pull back that we saw until about September last year. But then, since September, equity markets both globally and locally have seen a sharp recovery.

Speaker 1:

And over the last 12 months,

Speaker 1:

local equities are up 19.5% to the end of June and global equities are up in dollar terms, 16.5% and you add another about 15% returns from a weaker rand. Then global equities in rand terms are up over the last 12 months over 30%.

Speaker 1:

Very few of us would have said last year. June you would take a guess. How much would the equities what your returns are from the local market would be over 12 months? Time would have said returns close to 20% or returns over 30% for global equities and Rand terms 12 months later. So it's been phenomenally strong returns from equity markets.

Speaker 1:

But

Speaker 1:

but it's interesting. Very few investors

Speaker 1:

believe in these returns or feel confident

Speaker 1:

that these three type of returns are sustainable, and it's largely because of three things. The first thing is,

Speaker 1:

it's mainly a base effect. If you look at these, uh, these graphs, exactly what happened 12 months ago was at the bottom when markets pulled back. If you just look at this purple graph on the JSE all share index, if you take the 12 month return from the low base to nine, that's your 19.5%. But if you just take it

Speaker 1:

six months earlier and you look at your returns over an 18 month period, markets have basically just recovered what they've lost over the six months before that. So most investors over an 18 month period have had

Speaker 1:

no returns, so we've only seen a recovery of the losses that we saw in the first half of last year. So there is nothing to shout about and really been excited about your returns over an 18 month period from local markets and most investments on a global scale in dollar terms are still behind where they were 18 months ago. So it's mainly just been a base effect from the lows that we saw middle of last year.

Speaker 1:

Then the second thing, What keeps a lot of investors still very, very concerned

Speaker 1:

is we've seen interest rates go up across the world, and we know

Speaker 1:

if you have a period of consistent tight monetary conditions and rising interest rates, what typically follows is the big R tends to happen recessions.

Speaker 1:

And we all think this recovery that we see is just a typical dead cat that is doing its thing dead cat bounce. And are we in for a significant pullback that could come as a result of significant slowdown in economic conditions and that I'm going to leave it at this point? And I think will, uh, focus a lot around those questions so that questions around the sustainability of that, um, of markets recovery,

Speaker 1:

that is the big question that keeps a lot of people on edge. And then the last thing.

Speaker 1:

What keeps a lot of invested

Speaker 1:

unconvinced that this recovery is sustainable is the fact that this market recovery has been extremely narrow, not just in the global market but even in South African markets. If you look at the local market over the 12 months we've seen that the all share index is up 19.5%. However,

Speaker 1:

12 months and year to date, all the returns basically on a local market has come from five shares over 12 months. The all is up 19.59 0.5%. Of that, 19.5% came from Richmond. Another 3.9% came from nice passion process. Another 2.3% came from the two large gold shares Goldfields and Angler Gold.

Speaker 1:

The other 155 shares on our market contributed only 3.8% to the old shares return. That is even more staggering if you look at the year to date returns. On a year to date basis,

Speaker 1:

the market is up 5.7%. 5 of that, 5.7% came from the games on the rich Napa and process contributed to 2.1. The gold shares added a good 1.3%. The other 155 shares on the market actually went down

Speaker 1:

and actually declined 2.7%. It's been an extremely narrow market. It hasn't been a broad based market recovery and that same narrow market We also saw on the international side, where gains have largely been driven

Speaker 1:

by US outperforming the rest of the world. And even within the US, it's largely been driven by the US technology and even within the US technology sectors, it's largely been driven by what has been called the Magnificent seven.

Speaker 1:

And now the big question is considering that it's been such narrow market recovery. Can you really talk about this broad base recovery in equities and the sustainability of equities?

Speaker 1:

And does that give you comfort to just go back into equity markets and go and chase the recovery? And I think that's also some of the questions that you got got to ask and if we look at our performance over the last 12 months on the Discovery range on the local side on the equity selection side,

Speaker 1:

last year's performance hasn't been great on the domestic equity selection, but this year so far it's actually been fairly decent. We had an overweight position in the Richmond the NA process Yes, we should have had a bit more in gold shares but decent allocation to Richmond decent allocation to Napa process. These things have actually positively contributed to our returns. However, over 12 months, what has hurt us has mainly been year to date has been a more defensive

Speaker 1:

positioning on our offshore allocation. We have decent allocation to offshore, but within offshore, our equity allocation has been lower than a lot of our PS. And as we said way in the beginning of the year because we have some concerns around the sustainability of economic growth, we are more defensively positioned. Which does mean

Speaker 1:

should

Speaker 1:

markets continue to rally, we will deliver decent nominal or absolute returns. But we could lag some of our peers and that's exactly what we are seeing at the moment. Decent nominal returns on the one year.

Speaker 1:

But we are lagging some of our peers

Speaker 1:

and it's mainly because we are more defensively positioned and it has been a tough year and that has also been creeping through onto our three year numbers. However, if we look at the last, the last slide time is on my side,

Speaker 1:

every and any asset manager goes through a period of tough

Speaker 1:

performance

Speaker 1:

over the short term. No asset manager outperforms all the time. It's absolutely impossible, because for you to outperform, you do take active bets and therefore over the shorter period you will have periods of underperformance. The main reason is how do you manage risk?

Speaker 1:

And how do you actually have an investment philosophy

Speaker 1:

and a portfolio of construction? And how do you actually manage or manage or balance

Speaker 1:

that

Speaker 1:

conviction in investment ideas and the risk of potential losing money?

Speaker 1:

How do you find that balance? And how do you actively manage that balance to provide a more consistent return profile for your investors? And that

Speaker 1:

managing that balance has actually been able that we over any rolling 12 month period over the last 15 years, which is an extremely long period of time,

Speaker 1:

managed to deliver 75% out performance over any 12 month period 25% of the time over 12 months we've underperformed and these last 12 months have been part of that 25% of our underperformance, 91% of over any three year rolling three year period and 96% of out performance over any five year period. And then you guys will also say, Ah, Louis. But come on, Come on.

Speaker 1:

Um, everybody does it so well. So I compare our track record with that of the three largest asset managers, um, or funds in the ISA multi asset high equity sector

Speaker 1:

of peer groups. And Discovery Balance is the fourth largest fund in this sector. So you have competitor A is the largest competitor. B is the second largest competitor. C is the third largest fund in this sector, and you can actually see that

Speaker 1:

we've held up or done exceptionally well. The one competitor out there is competitor B, which is not a bad competitor and have actually over the, uh um in terms of its consistency, profile has actually been able to hold up. OK, this is the Discovery Balance Fund. But in terms of its worst drawdown over any 12 month period, Discovery is actually have done a better

Speaker 1:

consistency return profile over any 12 month period. And it's all finding that constant balance between investment, convection

Speaker 1:

and managing risk

Speaker 1:

that is key to managing money

Speaker 1:

and delivering consistent performance over a long period of time.

Speaker 1:

Big questions And the main important question is we've seen a recovery in equity.

Speaker 1:

Is this the beginning of a big bull market that we are seeing?

Speaker 1:

Or is there? Is it time to be a bit more cautious? And it's a time that you you tread with a bit more caution. Now leave these big questions, Johannes, over to you.

Speaker 1:

Good morning, everybody. Um, thank you very much, Louis and and ST for setting the scene and and giving context to To markets, Uh, I would agree with with everything that was said in this and add to it that I don't think anybody is enjoying, uh, markets at this stage. I haven't met a lot of people who are in euphoria or exuberance, um, and and telling us how how much they're enjoying what's happening in in global financial markets. And

Speaker 1:

we believe that the reason for that is we are late cycle markets go through cycles. Uh, we are in that phase of the cycle where policy is tight. Interest rates are high in South Africa and globally. Uh, when you have those tighter financial conditions, uh, slowdowns and growth often happens, which potentially leads to recessions.

Speaker 1:

Uh, post the recession, You get the, uh, sort of rewriting the growth euphoria, expansion phases that follow, and then we will go late. Cycle and slowdowns will will happen again. Markets move in in cycles. Um, unfortunately,

Speaker 1:

uh, we've had a decade of very low interest rates. Um, if you throw on top of that the monetary as well as fiscal stimulus that we saw during covid, uh, we are now dealing with the after effects of that. If inflation is well documented, uh, federal reserves and reserve banks hiking interest rates is well documented. The China reopening and recovery is is familiar to most.

Speaker 1:

Uh, but we need to get inflation and a lot of the macro variables back to what, uh, central bankers and economists believe are more normalised or normal levels for us to to carry forward and to go forward.

Speaker 1:

So, yes, there's a slowdown. And, yes, we're dealing with a lot of unresolved variables in markets at the moment, I must say, I've been in markets close to 20 years, and I haven't I can't remember a period where we've had so many unresolved variables at one point in in in the market. So we're trying to to position portfolios for the potential outcomes and the probabilities,

Speaker 1:

and and I will share some of those probabilities and outcomes and and and facts that we've been debating and discussing and trying to get conviction around. How do we position ourselves during this late cycle? Uh, potential slowdown, recessionary phase and into 2024 potentially a recovery phase on the left hand side, you can see what the bond guys are thinking. Now, there's this general, uh, bit of banter that goes on in in in global markets between bond, uh, investors, uh, fixed income investors and and equity investors.

Speaker 1:

Uh, the markets believe that the fixed income macro bond guys are more clever than the equity guys here. You can see on the left hand side the bond investors have for a while Now, Um, we we we talk about

Speaker 1:

the, uh, recessionary indicator being bond yields that are inverted. Uh, so you've got your short term interest rate expectations and your longer term interest rate expectations, and that differential is negative. 90 basis points or 0.9% just short of 1% today. And what that means is that the market is saying the Federal Reserve and and central banks are going to have to cut interest rates quite aggressively.

Speaker 1:

Uh, because of a recession. So the bond investors are saying the recession is coming, by the way, this, uh, inverted yield curve. So the longer term yield curve being lower than the shorter term yield curve because of the expectation of interest rate cuts to come has been inverted for the longest period in 40 years. So the bond guys have been expecting this recession for quite a while now, and this recession hasn't fully hit, uh, in in global markets. I mean, if you look at where equity markets are today, uh, the S and P, the NASDAQ indexes are all up double digits year to date.

Speaker 1:

So the equity guys are saying no, we still dancing. But we're dancing close to the door. The bond guys are saying, Watch out, you're gonna get you're gonna get hurt and burned

Speaker 1:

One of the reasons on the right-hand side why we haven't seen this recession. And one of the variables that we're closely following is tight labour markets. Uh, maybe this is one of the after effects of covid, uh, labour markets being incredibly tight people. Uh, if you look at unemployment rates in the US, if you look at certain leading indicators job openings, et cetera, uh, the services sectors have recovered quite strongly since covid and and therefore one of the macro variables. Labour markets in the

Speaker 1:

the US are quite resilient. And I think if I'm a central banker, if I'm a Federal Reserve Central banker member, uh, I would be quite frustrated. Having hiked interest rates so aggressively in the next slide in the bottom left, we show you where interest rates were 12 months ago and where interest rates are today. So if I was a US central banker with interest rates being below 1% 12 months ago, and I've hiked 400 a bit more basis points

Speaker 1:

fall and a bit more percent, and still markets are incredibly, uh, labour markets are incredibly resilient. Equity markets have rallied quite aggressively. I'll be scratching my head and asking myself why there's a study that's recently been published by the ECB, which we we share it with you on this slide. Apologies. There's a lot of detail on this slide, but but in short, the graph on the right hand side shows you when financial conditions started to get tighter and you can

Speaker 1:

see that was sort of halfway through last year, 2022. Since then, financial conditions have become more and more tighter. And then we had the little banking crisis or the wobble with certain regional banks in the US, and you can see that certain liquidity conditions would become more favourable to support some of some of those banks. So on this path of restricting, UH, higher interest rates, financial, tighter financial policies, they suddenly had to do a bit of a

Speaker 1:

a bit of a u-turn and that prolonged the effect of of interest rate hikes and and the more gave more resilience to to potential markets to global markets. Another point to make is that interest rates were hiked from incredibly low levels, so it probably took longer for conditions to get really tight for conditions to really start biting into the growth and into consumer spending and into the corporate balance sheets or income statements.

Speaker 1:

Another point to make is that it takes time for fixed rate, longer term loans to reset some loans. For example, in the UK are agreed on a two or a three year basis. The interest rate is fixed for a certain time period, and only when that loan resets do you reset to a to a higher interest rate or to a higher level.

Speaker 1:

And then another point is we. We were arguing about supply chains and disruptions around supply chains during covid, so interest rates hit the demand side of the economy. It hits the spending, it hits the capital expenditure.

Speaker 1:

Uh, it it doesn't really affect the supply chains. So as we had the reopening of supply chains, that was a potential benefit to growth and and and to and to market. So the the hiking cycle hasn't been fully reflected in growth and earnings expectations, and these are some of the reasons we think why it's taken slightly longer to to reflect in in growth and and earnings expectations. So,

Speaker 1:

as Louis highlighted before, we've taken a more defensive approach on a developed market exposure. Uh, we were concerned and still are concerned about the impact of these higher and tighter financial conditions, less fiscal spending and less fiscal support. We worried about the earnings and growth expectations and the valuations on a developed market on a global scale. We have, however, allocated more of the capital to emerging

Speaker 1:

markets where we find more cyclical and also going into this rate hiking cycle. Emerging markets were earlier on hiking interest rates and therefore at the point to potentially be some of the first to start reducing interest rates and cutting interest rates on the emerging market side. So tight liquidity excess savings which are being eaten into the slowdown and potential recession in the developed world, has given us a more defensive tilt on the on the offshore side.

Speaker 1:

We do agree that there's recently been some good news on inflation. Core inflation, which excludes energy and labour impacts, uh is one of the one of the main variables that the Federal Reserve are are following and monitoring some of those indicators. Inflation starting to come through lower than than what people expected.

Speaker 1:

So therefore, inflation heading down and lowered to where central banks would feel more comfortable with it. Does it reach the levels of 2% which they wanted to to to to achieve or does it get stuck around three or 3.5% those are some of the uncertainties, but we would agree there's been some positive news around inflation.

Speaker 1:

We do think that central banks will be reluctant. They would first want to make sure that they get closer to their targets and inflation and they would first want to see our resilient labour markets remain and the impact of all of this on on labour markets before they start cutting in developed markets globally.

Speaker 1:

Data points in China recently have been weaker. Uh, Chinese exports, for example, have been weaker, and the reason for the weaker exports are because of the rest of the world slowing down. So therefore, the manufacturing engine of the world also manufactures slightly less because of the slowdown globally and then the slower property market. Lower levels of confidence in China are are sort of

Speaker 1:

holding back and creating the Chinese recovery or growth for this year to be slower than maybe what what people expected. Still, it's a growth rate around 5% in China, and we believe that the the tide has turned the boat has turned in in the Chinese context. Last year was a very disruptive year with a lot of regulatory intervention

Speaker 1:

concerns around growth, political changes that happened in on with members in the in the China decision making framework. We believe that a lot of this has become tailwinds uh, into 2023 and will continue for the rest of the year and going into 2024 engagement with the rest of the world on on the political front, as well as small, sort of focused stimulus in the Chinese economy, we believe we'll continue a a much more open conversation with regards to what previously was highly regulated and now

Speaker 1:

a lot more, uh, discussion happening in, say, for example, the tech space and the financial services space, uh, than than what we saw in 2023. So we think the recovery may be slower than what everybody was hoping for. Still continues on the Chinese side and then in South Africa, we're finding a lot of very attractively priced investment opportunities. What you want is you want confidence and you want growth to stabilise and start to improving. I think if you look back at where we were three months ago

Speaker 1:

with a lot of political questions asked around our alignment or or neutrality in with regards to to politics and with regards to the Russian Ukraine situation and with regards to the Western world, the uncertainty around bricks, people thinking about level 67 and eight stages of load shedding fast forward 90 days to where we stand today and level one and level three loadshedding seems like a small win. Um, not that I think we should celebrate any stages of of load shedding.

Speaker 1:

But what was feared and what was priced into markets specifically on the South African side 90 days or three months ago has played out slightly better than I think, what most people expected. And with a lot of this in the base now and looking into 2024 with a lot of renewable energy and a lot of bid windows open and people uh uh helping to supply energy into the grid. Um, especially also when a lot of the new su supply that's been under maintenance can be reengaged into the into the grid.

Speaker 1:

Um, a lot of, uh, fear around a very cold winter. And and yes, we've experienced snow, which we haven't seen in quite a while in certain areas of South Africa. But as we roll into the summer months and as we get more of this supply, uh, into the grid and and electric, uh, availability factor, electricity availability factor higher. Um, which we have seen over the last few weeks then surely into 2024. It looks better than than some of the some of the experiences we've had in the second quarter of this year.

Speaker 1:

With regards to China, you can see just some graphs, and I'll quickly go through this. You can see how the consumer confidence has started to pick up on on the Chinese side. You can see that certain focused areas of stimulus with regards to,

Speaker 1:

um, deposit reserve ratios and requirements for for banks. Uh, you can see that commodity prices People often look at commodity prices, and they say, Oh, the the the level of commodity prices are so much lower than what it was 12 months ago. But you can see how it's actually picked up relative to where it was in 2018, 2019 and 2023 levels are are much more supportive for the for the commodity companies.

Speaker 1:

If you look at the price you pay and the earnings you get in some of the other emerging markets. What we highlight here for you is is the the earnings per share growth for this year and next year. Uh, double digit earnings growth that you see in China and Hong Kong. You pay a 10 or 10.5 times forward PE evaluation that you pay for for that fund for those fundamentals for those earnings growth profiles that you get in some of the other emerging markets. And if you look higher up in the slide,

Speaker 1:

I'm gonna try and see if I can. I can show it to you with my cursor. If you look higher up on the slide, some of the earnings growth that you find in Europe and US, which is I would say, single digits and and and and and 10% below double digits. And the price you pay for it is is quite a big premium to what you pay in in other emerging markets. And therefore we've tilted our portfolios more towards these developing markets than we've tilted them, uh, towards developed markets and we're finding more opportunities in in those regions.

Speaker 1:

Bonds has been one of our uh, a bigger, uh, we've allocated more towards developed market bonds. So one of our distinguishing positions, Uh, and And if you think about where we are in the if you think you're getting close to the peak in monetary tightening, so therefore peak in interest rate hiking cycle. If you believe inflation is rolling over as we've seen, data points start to prove. So if you think the next move is the interest rate cut into 2024 if you think inflation is rolled over and you

Speaker 1:

that growth is slowing down, bonds tend to outperform first. And after that, when you start getting the interest rate cuts is when you start tilting towards equity. So we're looking to, uh, if you look at this specific slide, you want to buy equities when the earnings yield of equities are at the higher end of of this slide. At this stage, the earnings yield that you're getting or the yield that you're getting from bonds are looking much more attractive than what you're getting from equity. So bonds first and only

Speaker 1:

equities to follow after that has been some of one of the investment opportunities through buying Australian Canadian and New Zealand bonds on a on a global framework. And we also believe that these economies are vulnerable because of their level of indebtedness because of weaknesses in the housing market. And their central banks would want to be some of the first to start cutting interest rates. And therefore we think there are in addition to the yields, some good capital returns that will potentially generate in some of some of these bond markets.

Speaker 1:

South Africa. Uh, people like to be negative around South Africa. They like to focus on on the on on what is on the front pages of newspapers. As I said, a lot can change in in in two months or three months with regards to how negative we were then and and potentially finding, uh, lower levels of load shedding potentially companies well provided with strong balance sheets and generating healthy free cash flow.

Speaker 1:

Uh, a lot of of I think the the valuations have also been exaggerated by money leaving the country, uh, a lot of people with regulatory changes. Pension fund changes have recently allowed pension funds to not only invest 30% offshore, but can now invest up to 45% offshore. So I think with the negative news that we saw a few months ago, a lot of people have taken that opportunity to sell some of the assets

Speaker 1:

in South Africa and and transfer some of the money offshore. The rand moved quite aggressively with a lot of the negative news, and that gives mispricing opportunities. So if we look through the noise in the South African context, we take a hard look at the earnings expectations at Mashaba on our on our retail side and a guy like Chris Stewart has been a bank and a banks analyst for a few decades are stress testing and kicking the tyres on the earnings expectations

Speaker 1:

for for the banks, serene boon on the insurance companies and our property sector, our property team are are looking quite hard. And what are the earnings expectations? How bad can it get and where potentially is the opportunity with the market over shooting on the downside and investing in some of some of these S a equity opportunities because on the left-hand side we show you that they they they're fairly well priced at the moment and S a bonds is also looking like a in real returns, incredibly attractive opportunities relative to a lot of other other global opportunities.

Speaker 1:

The rand. There won't be a a webinar or a presentation without some view or thoughts on on the South African rand. We show you here some of our purchasing power parity calculations and and some of the ways in which we evaluate where the rand is, and and and and at various stages through the cycle, you can see that it's touched the upper end of of of this band when it touches the upper end of this band. When it goes through a period of of weakness,

Speaker 1:

it tends to correct. It tends to strengthen for a short term, and I'd be the first to admit that over the medium to long term 4 to 6% rand weakness is what you should be thinking about. And that's because of growth differentials in South African economy, not growing as fast and as as as healthy as as some other other geographies. But you have to be wary when you get to these points of extreme weakness and what the fundamentals are showing here,

Speaker 1:

and by the way we took this at the Rand at 18 71. It's currently sitting closer to 18 rand. It's actually broken through 18 rand this morning. It's got a 17 handle on it. What we try and do is we try and hedge, uh, some of the offshore exposure so that we don't get these great growth and earnings expectations on the offshore side. But we hedge that back into into South African rands to try and see if we can enhance, uh, the return profile. What I'm trying to also say is we don't think at the moment is the right time to shift a lot of your money offshore,

Speaker 1:

and another point to make is if you think we are late cycle, post the recession. Usually you have the recovery, the growth and expansion phase. As I said earlier on and then, money tends to flow into emerging markets. People try and find those additional growth opportunities where there's higher growth in China and all economies that benefit from China, such as South African economy and in those environments, you

Speaker 1:

emerging market currencies tend to have, uh, periods of of strength, which is also, as you've seen. These cycles have have have played out previously in 2008, Uh, also during covid Rand weakens. And then, uh, for a period after that, you have a AAA stronger rand in environment. So watch out to to increase your offshore, uh, too aggressive at at at current levels.

Speaker 1:

Big question in the next few days is the South African Reserve Bank. Uh, what we show you on this slide is the the forecast for for not only South African inflation, but also interest rate expectations. So what you can see on this slide is, is is how we also think South African inflation comes back into the band. The 3 to 6% band that our Reserve Bank wants inflation to be at and then the markets pricing potentially another 25 basis points of interest rate hikes from our South African Reserve Bank.

Speaker 1:

I must say, I think it's a very 50 50 call at this stage. Um, a lot of indicators are there. A lot of variables have changed since the previous uh, Reserve bank meeting. At that meeting, the Reserve Bank came out and said that they think, uh, South African interest rates are in restrictive territory already.

Speaker 1:

Uh, the rand is not at 18 75 as I showed you in the previous slide or above 19. It's got a 17 handle when they sit down to have this meeting. We were at Stage 56 loadshedding at that stage. We are currently at stage 1 to 3. So a lot of variables have played out slightly more in favour of of of, of the reserve bank variables that they would use in in their Q PM models. So it's a very 50 50 call for them to potentially stay on hold versus another 25 basis point. Uh

Speaker 1:

um, increase in in South Africa. So, um, however, whether they hike or don't hike, I think there will be a a narrative around we we think we've done enough for inflation to return to the midpoint of the 3 to 6% band, and and obviously this also depends a lot on what happens globally. Central banks globally also go on hold and and potentially start talking about cutting. As I've alluded to earlier, with some weak economies wanting to reduce the interest rates

Speaker 1:

that might give a window of opportunity for our Reserve Bank to do exactly the same

Speaker 1:

and then the last slide before I go into portfolio positioning. What's also an interesting dynamic that have played out in 2022 is that cash is starting to compete for a position in the portfolios again. Because of the interest rate hikes that we've discussed during this presentation. The spread between what you can get in a bond and cash have narrowed quite dramatically previously. In a bond, there was 6% return relative to inflation. Now it's much less

Speaker 1:

relative relative to cash as well, because the interest rate that you can earn on on cash in your portfolio is not as low and also globally, not as low as as as what it was before. So interesting dynamic in in portfolio construction. And therefore you will see we also carry slightly more cash to put us in a position that if we do see the growth slowed down, if we do see the recession, we've got that cash at hand to invest and and to up the growth in the equity side of of of the portfolio.

Speaker 1:

So a few minutes on, what do we hold in the portfolio? Maybe just a quick recap when we think about all these asset classes and all the levers that we can pull and all the opportunities when we discuss this and maybe one of the benefits of working at 91 is we can see how our global colleagues manage multi asset portfolios. Total return portfolios, equity only portfolios on a global scale. They manage those portfolios relative to the dollar

Speaker 1:

global benchmarks. And we can leverage all those ideas and put those ideas into into the portfolios that we manage for the discovery clients or for the discovery range of products. When we look at these ideas, the fundamentals that go with these ideas the growth, inflation and policy framework of each of these asset classes and ideas or geographies are important.

Speaker 1:

The price you pay the valuation is is important. And then are we the first or the last people to figure out that this is a good investment idea? It's a bit like buying a house where your house is positioned relative to schools, highways, security, estate. All of that is considered to be the fundamentals of of the house. The price you pay it is well known. You can see at what price it listed. And you have to evaluate those fundamentals relative to what?

Speaker 1:

What you pay for those. And then and then are you the first or the last person to figure out that this house is in a good neighbourhood? Are you early on in the development or are you Are you late to the to the idea? The same principle applies when we look at investment opportunities in South Africa, the fixed income teams, the property teams, the commodity teams, the equity teams and similarly on on a global scale.

Speaker 1:

So across the range of Discovery products, we highlight here for you Discovery, cautious Discovery moderate and the Discovery Balance Fund. In the cautious range, we carry slightly lower growth assets. So a bit more of a cautious approach, lower equity so that the bottom two buckets here are your South African equities and your global

Speaker 1:

equities, and you can see we carry slightly higher bonds and and and cash in the portfolio. The moderate portfolio steps up by about 12 or so percent, slightly more growth assets, and we can increase that to to a higher number. But because of our slightly cautious stance, we've we've only got 50% in the moderate range and in then discovery balance.

Speaker 1:

We've got about 64% in equity. If you add some commodities and list the property, it gets you to 67.2% exposure to to growth assets. What you hold is more important than how much you own. So the mix of what you own inside those asset classes this selection, I tend to believe, is more important than how much. Whether you've got a defensive tilt or a cyclical tilt or an aggressively growth tilt in your portfolio is

Speaker 1:

more important than than than than how much you earn and to show you as well how we've changed the portfolio since the beginning of this year. So December 31st of December or the first of January 2023 over the last six months, you can see we own slightly less S, a equities we trimmed on the S a equities in the first quarter of the year. Concerned about the growth, slowdown and uncertainties with regards to the electricity availability,

Speaker 1:

we've allocated slightly more to your to the global, uh, defensive ideas, and I'll highlight some of those defensive ideas on on the next slide. We trim some of the property when we speak to the retailers. When we speak to the companies in South Africa and ask about the dynamic between the landlords and the retailers, they tell us that when you go through various stages of load shedding, that is how the conversation goes. When there's level five and six of stages of load shedding,

Speaker 1:

the landlord is in a very weak position to renegotiate and discuss uh, uh, leases and and and rental revisions, Um, with with some of the some of the companies that they have as as tenants. And we felt that it's gonna take slightly longer because of the electricity uncertainty for the property sector to to recover, we would agree they look incredibly attractively priced, but we are a bit worried about the fundamentals and the dynamics that come with, uh, a lot of, especially in the office and in the retail space.

Speaker 1:

And then, as you can see, we we we've owned slightly less South African bonds. Um, we we've taken opportunities where our bonds have rallied to trim some of the some of the cash that we have in South African bonds And as I've mentioned for reasons mentioned before we, we've allocated more towards some of the offshore bond ideas. It also helps with the risk adjusted profile of the portfolio developed market bonds. Defensive bonds tend to rally or be areas of safer

Speaker 1:

when you go through recessionary and and growth slowdowns. And and we tend to think that those bonds will do well before the equities in on On on the global markets into 2024. Uh uh comes out of the recession and and and starts to participate in a in a further rally. And as I've mentioned, we own slightly more cash. And the reason for that is we can make use of that cash that as we go through wobbles and uncertainty over the

Speaker 1:

over the next few few weeks and months, and as the recessionary stress or dynamics potentially play out, we can use that cash and up the the equity assets of the portfolio back to levels above 65 and closer to 70% if we if we find the ideal opportunity. So currently, 38% of the portfolio are invested offshore and 61.8 of the portfolio are invested in South Africa.

Speaker 1:

I've mentioned what you own is more important than how much and and maybe the first point to make on this slide is on the right-hand side. The equities that we hold in the discovery. This is with regards to the Discovery Balance Fund, but it's also applicable to the moderate and cautious funds. 76% of the equities generate their revenue in hard currencies, and 24% of the equities generate their revenue in rands. So the mix of of equities that we have in the portfolio are very much tilted towards offshore. Um,

Speaker 1:

the the buckets we've allocated them in for few years shows you where can we access defensive opportunities, growth opportunities and cyclical opportunities? And you think about the S a market. We don't have the same kind of growth stocks that you find on A on a global scale. Yes, we have a lot of cyclical stocks our banks, our resources, stocks, even stocks such as Richmond. They've got a very cyclical earnings profile. They go through cycles because of commodity prices because of interest rate cycles, et cetera. So we already start with quite a high bottom left bucket in the

Speaker 1:

slide Quite a high local cyclical market because of the the the the mix of and sectors we can get exposure on the South African, uh, JC all share index. So some of our banks and some of our retailers go into into that pocket top left. You can see some of the resource counters which generate their revenue outside of South Africa. So the point to make is when you when you look at what's listed in South Africa, not all of them or very few of them have got exposure to the South African economy. A lot of them depend on what's happening in global economies and trade potentially

Speaker 1:

of China more than the trade of of the South African economy. So the diversified miners, uh, stocks such as Richmond and and the platinum miners all all depends on what, what what's happening globally. We We also add to that, uh, companies such as intact financial that's a Canadian insurance and a bit of property exposure. Company Bank is an Indonesian. They're the capitec of Indonesia, with an unbelievable branch network, a branch network that was actually used by the government to help with the distribution of of covid vaccines.

Speaker 1:

So the way in which they into rural areas into very different areas in Indonesia, it's a bank that's gonna give you 14 15% earnings growth, and you're paying a 13 times forward PE for it. And in the overall context of of what we can find from our opportunity said, that stacks up as a as a very strong idea. Train technologies. It's a company that helps with ventilation, air conditioning, uh, in houses and in and in and in businesses. And it's something that, given where, uh, global warming and the environment is going, is is a is a company that's really benefiting from from strong demand for for their products

Speaker 1:

in the growth bucket. As I said, we don't find a lot of good growth stories in South Africa. Capitec may be one of them. Clicks is another one. Clicks is not the most, uh, the cheapest stock out there. Uh, up until recently, transaction capital was one that you can consider in that In that growth pocket, we hold a little bit of capitec. We find better growth opportunities on a on a global scale. Some of the tech names you'll be familiar with

Speaker 1:

Microsoft. MasterCard is a is a phenomenal business. Universal music We've highlighted on some of the webinars before, uh, the whole dynamic of monetizing, uh, music and the way in which the record labels have changed to some platforms, such as Universal Music and Sony controlling a lot of the record labels out there and people willing to download their own playlists relative to buying a AAA DVD or or or music Uh uh, a A whole

Speaker 1:

before and then Whoopi Lead is a company that actually manufactures solar panels and batteries, uh, in the Asian market. Um, and it's a phenomenal growth opportunity. Also on the defensive side, some of the healthcare names Louis mentioned that because of this defensiveness on the offshore side, we've we've we've underperformed slightly to maybe the magnificent seven. So those people that held the magnificent seven the the apples, the Amazons, the alphabets,

Speaker 1:

the the videos of the world have have had phenomenal performance because of those seven stocks driving quite a lot of the global returns. We've allocated more towards defensive stocks because of our concerns around global, Uh uh growth slowdown. Um, we don't really own British American tobacco on the local side. So to allocate, rather to Philip Morris on the global side, Rent to Kill is a company that's recently done acquisition and and sue those acquisitions

Speaker 1:

that they get through that. Now people might look at it and say, Pest control. Anybody with a bucket and a van can can do pest control, and we would agree that it's got low barriers to entry. But when you start scaling these business opportunities, the distance you travel, the efficiency of the products that you use, um, goes through AJ curve effect. And and as they do these acquisitions, we believe the market is underestimating the impact on the earnings profile of Of, of, of the business.

Speaker 1:

Um, then we we do still hold some of the gold stocks. We believe that at current gold prices, the earnings expectations, ST highlighted. We like to invest in companies where the future earnings expectations are being revised upwards. So positive earnings revision profiles in a lot of these businesses and the price we pay for for these positive earnings revisions, pro profiles we believe is is is very reasonable and and fairly priced, and then we hold stocks like shop, right? Uh, management changes over the last number of years have

Speaker 1:

come through very strongly. For ShopRite, a big focus from management on return on invested capital is is is very promising for them And I'll, I'll highlight ShopRite and and also its a bit later on on some of the South African ideas that we've that we've got allocation, um, towards in in in your portfolio,

Speaker 1:

Napa and process quickly. No presentation in the South African context goes, uh, without mentioning Napa and process and the recent value unlock transaction that we've seen in the way in which they're now simplifying the group structure. Um, having Napa and process more, more separate and separately listed instead of a lot of the international and foreign investors, uh, felt that it's too complicated

Speaker 1:

group structure. So that has already started to bear fruit in the in sort of the discount closure of Napa and process the holding company discount. But for us, when you look at Napa process, it's a story around Tencent. We've got analysts who sit in Hong Kong analysts who cover Asia Tech and through the research and the work that they do, Tencent actually stacks up together

Speaker 1:

with Alibaba as some of the good and and and all areas of of of, uh, tech, where we want to allocate capital towards. So, uh, because of the regulatory uncertainty, because of AAA lot of, um, lower confidence and and concerns on the on the tech side in China through 2022 Tencent has also gone through an extensive process of cost cutting and optimising

Speaker 1:

the expenses side of the of the income statement. We starting to see some of the benefits of that coming through as they are now, also monetizing more parts and bigger parts of their business. So you've got a tail went to their revenue line and you've got AAA benefit of of better margins, which is leading to upgrades in the earnings profile of of 10 cent

Speaker 1:

gaming. Approvals have started to come through. We started to see advertising pick up, and the fintech part of 10 10 is also is also benefiting. So the positive earnings divisions and the price you pay together with the value unlock that we're seeing on the Napa process side, um, has made us allocate quite a quite a big portion of the South African equity to these investment ideas

Speaker 1:

just quickly. I I've spoken about the Chinese growth being slower and and and the reopening trade. The exuberance of the first quarter are slightly slower. Second quarter, we're still constructive on as I've mentioned, the 5% growth rate for China. The the commodities

Speaker 1:

that BHP Billiton as a diversified minor manufacturer that they produce copper and iron ore and coking coal are very dependent on on Chinese demand. If you take these commodity prices and you stick them into your model bottom left, you can see the spot prices and earnings expectations are therefore higher than what the market is is is currently expected. You're buying these resources stocks, not only BHP, you can look at Glencore and you can

Speaker 1:

I can argue the same for various other uh, commodity companies where we can get exposure to are they are generating quite a lot of free cash flow. So the dividend yields the money that you get back. You can see on this slide we highlight eight and 9% of dividend yield that you get back from these resource counters. The gearing is very low. Some of them are operating in an environment where they've got cash on their balance sheets, uh, healthy free cash flow yield. And as

Speaker 1:

the China sort of stimulus and growth continues into 2023 and 2024 we believe that, uh, there's a There's an investment opportunity on on some of these diversified miners and and and the miners and similarly on the China reopening and the Chinese consumers starting to travel again, uh, top right hand side. We show you our rich benefits from not only China being 29% of

Speaker 1:

their regional sales, but the Chinese consumer also travelling into Europe and a lot of travelling and tourism reopening again. It's like for two or three years we didn't travel because of covid, and now everybody wants to travel all together at once. But we've seen a lot of the spending in in in Europe and other parts of the world starting to pick up the benefits of that for the revenue of of Richman.

Speaker 1:

Um, they've also, uh, had the exclusion of certain JVS and certain companies and associates, uh, that that used to be on their balance sheet. So the benefit of that coming through in the on the earnings expectations. And you can see that

Speaker 1:

the the the updates that we're getting not only from Richmond, but from various other luxury goods companies are indicating that that the the margins and the volumes that they are selling are are exceeding expectations. And you can see in the bottom left are the markets consistently and continuously upgrading earnings expectations for stocks such as Richmond. Also, the business model for Richmond has changed slightly. They used to

Speaker 1:

more on the wholesale side, which means they supplied to the retailer, and they didn't really have the the direct knowledge of what exactly the end consumer was was looking for. They've changed their business model slightly, so they've got more retail direct, uh, selling now, which means they've got much better intel in what their end client wants, and they can sell these products at at better margins.

Speaker 1:

So one of the ideas which globally we've we've we've allocated to a company listed in South Africa but benefiting from from global trends. Two of the retailers I've mentioned ShopRite and the focus on return on invested capital. Also the market share that ShopRite is gaining relative to pick and pay and spa is phenomenal. The way in which they position the checkers brand

Speaker 1:

the way in which they are are are managing the the the mass market and the exposure to the to the mass market through you save and and and gaining market share. There has really helped from a volume perspective for ShopRite, their product offering the checkers fresh offering that they've got, um, and our checkers have managed to to start gain market share. Um, with with the higher end products has has has been phenomenal the way in which management have addressed, uh, the return on invested capital and the cost side of it.

Speaker 1:

Business has has been phenomenal. So our preferred food retailer and then on the clothing side, we we used to own a lot of sin and true words, as I've mentioned higher interest rates and a slowdown and and and and consumers being under stress in South Africa, we sold out of some of those ideas six or nine months ago. But we've we we we still believe that there's a good company specific, specific story in in the case of wools exiting Australia. So the impact of that on their balance sheet uh, the fixing or the realigning or

Speaker 1:

or strategy? That's much better on the fashion, beauty and home side of of Woolworths and the way in which they've improved on their clothing and and and also the stock management, less writedowns and less discounts. I always been joking, saying that when you walk into Woolworths, it's It's some some terrible clothing with some good food at the back. They want you to walk all the way to the back and hopefully you you buy some clothing on your way there. They've really upped their offering on the fashion, beauty and home side, and we believe that there's a

Speaker 1:

A, a renewed strategy and a renewed focus from management and with a better balance sheet. And we believe that returns back to clients and back to shareholders. Will, Will will also look a lot more attractive,

Speaker 1:

then exposure to financials in general. Um, we believe South African banks are well capitalised. We believe they are well provisioned. Um, we believe that, uh, they've benefited from the, uh what we call endowment effect. So the margins with regards to interest rates work in their favour. When you go through an interest rate hiking cycle that benefits the income statement. The transactional activity have also been good, and most of these banks when they when they report they report revenue of low double digits. They've also managed to control their costs

Speaker 1:

quite well. So the cost to income ratios are looking quite favourable, like prep provision operating profits. So the operations, the transactional activity, the loans activity are looking very good. So you're getting nice strong prep provision operating profits, and they're well provided. So we talk about the credit loss ratios or the bad debt ratios that these banks have. They guide well. They indicate to us that it will be within a range, and and even though the consumers are under stress and there's a potential risk of that, um, the the

Speaker 1:

the way in which that process is managed and and the quality of the books on the South African side looks looks quite healthy. So you're buying South African banks at a 678 times forward PE, you're gonna get earnings growth from somewhere between eight and 10% and you're going to get a dividend of somewhere between six and 8% so you should get a double digit return from a South African bank, and you're paying a single digit PE for it. And then I've mentioned MasterCard. But in impact on the on the Canadian side from the financial services side, uh,

Speaker 1:

company that we also think is operating in a very strong and healthy developed market. And I've mentioned bankrupt out in these in these banks, you also get a 10 to 12% earnings growth, and you're paying a 10 to 12% 10 to 12 times forward PE. Plus you get a 2 3% dividend yield on top of that, so you should get a double digit return from some of these financial services companies. And and, as I've said, we leverage here of the research our colleagues do on a global scale to make sure that the quality and the free cash flow and the balance sheet of these businesses are are are healthy.

Speaker 1:

Last slide from my side to conclude, um, for us, we started the year and and we said to clients this year it's all gonna be about growth. When does the slowdown happen? When does the recession hit? People thought that the recession was gonna happen halfway through 2023. And for reasons highlighted upfront, we still think that growth slowdown is coming and the risk of a recession

Speaker 1:

hasn't completely vanished. So the concerns around that and how that plays out in the next 3 to 6 months, Uh, it is something that we're keeping quite a close eye on. So identifying growth opportunities through the next few months and positioning ourselves correctly into 2024 is is super important. You want to be in a position where you

Speaker 1:

you've got some cash or some dry powder available where you are in a position to take advantage of some of these opportunities should they present themselves, We believe that inflation is close to or has peaked. Uh, we also think we are at the peak in the interest rates, Uh uh, environment. So the next move into 2024

Speaker 1:

uh, if we can muddle through the next month or two is that we will start thinking about interest rate cuts and and also in South Africa, uh, a 75 to 100 basis point interest rate cuts into 2020 or during 2024 is something that I think the South African consumer and the economy can can really look, look forward to. We are concerned about the leading and lagging indicators. So the higher interest rates I showed you where we were 12 months ago and where we are today, it takes time for that to fully reflect in the economy. So some of the lagging, uh, effects

Speaker 1:

of higher interest rates is it sometimes takes 6 to 9 months for these to philtre through the the economy as the loans reset. And and and as this eats into consumer and corporate corporate spending, we are finding a quite of a lot of very attractively, uh, priced opportunities, especially on the South African side. And we're looking to to position ourselves, uh, and and take advantage of some of some of those opportunities. And the benefit of having a globally integrated business is that we can leverage all the teams

Speaker 1:

in different asset classes in South Africa, but also in different asset classes and geographies across the rest of the world. For us to find the best ideas from a bottom up perspective, because ultimately we can have the best macro views we want. Portfolios needs to get constructed from the bottom up. We need to decide on which equity and which bond Which property company and which commodity to buy in the portfolio to get the overall asset allocation and and and portfolio outcome.

Speaker 1:

Thank you very much. And thank you for everybody who've spent the last 55 minutes to an hour with us. Um, thank you very much for for for doing that.

Speaker 0:

Uh thanks, Anderson. Thanks, Louis. It was a great presentation, as always. Uh, we recorded this webinar, and we'll make it available to all of you shortly.

Speaker 0:

Um, also, 91 is currently busy recording the quarterly fund web costs. So these are short five minute videos done by the main portfolio managers, and it covers the fund positioning and the recent performance. These will be hitting your inboxes in the next week or so, so keep an eye out and do yourself a favour and watch these Webcasts.

Speaker 0:

Um, yes. And thank you so much to all of you for joining us and your continued support until next time

Show More

Show Less